Market Commentary - January 2025

“When the facts change, I change my mind.” — John Maynard Keynes

While many people were opening gifts over the last few weeks, I think it is time to wrap up 2024.

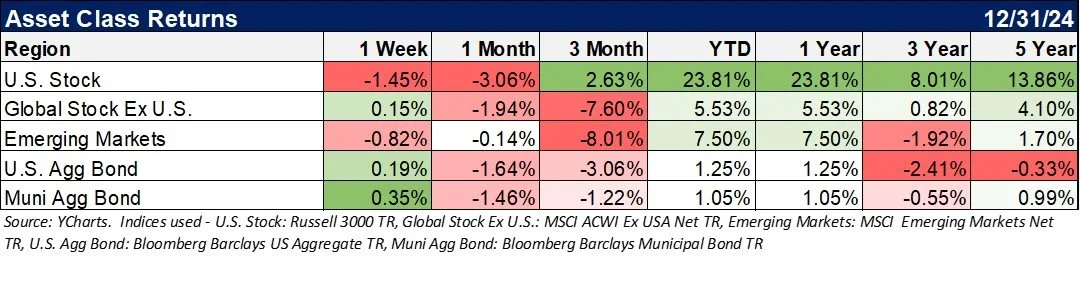

The years 2023 and 2024 were wild in a few ways. In 2023 the S&P 500 had a return of 23%, and in 2024 it had a return of 24%. While we can’t predict that 2025 will return 25%, the returns of the markets over the last few years have been very impressive, considering that the backdrop was a regional banking crisis and a crazy amount of geopolitical risk. U.S. stocks have been climbing a two-year wall of worry.

The why? There have been just four soft landings in history: 1968, 1985, 1995, and most recently, 2024. Because soft landings are so rare, market participants don’t have a lot of data points to make bold predictions about the future. Going into 2024, investors were questioning whether the Fed could engineer a soft landing with this economy. Over the course of the year, market participants pointed to cracks in consumer spending, employment risks (we noted the 'Sahm rule'), and an inverted yield curve that had 'never been wrong' about predicting the next recession. None of these issues materialized, of course. The U.S. economy is on pace to post almost 3% GDP growth in 2024.

There is always a reason to sell your investments. Heading into 2025, the doubts in the market revolved around things like Trump Administration policy uncertainty, ex-U.S. growth, higher-for-longer rates, market concentration, and more. Here are a few of the questions we find ourselves asking as we close out another stellar year for stocks:

Can valuations go any higher? Everyone probably asked this question a year ago, and it is perhaps even more relevant today with the S&P 500 trading up at a 2025 P/E multiple of 21.9X. EPS growth is expected to accelerate in the coming years due to deregulation, potential tax cuts, and a strong consumer. The growth of the denominator (Earnings) allows for compression in the P/E multiple without hurting stock prices. Forecast accelerating earnings growth according to Factset is 15% for 2025 (as of 11/26/2024).

Will the Magnificent 7 stay magnificent? Market concentration emerged as an issue in the wake of the pandemic as investors crowded in and, by many measures, is the highest in history. High valuation and market concentration suggest below-average long-term cap-weighted equity returns. But in the year ahead, forecasting has the Magnificent 7 continuing their pole position as the fundamental drivers of earnings growth.

Will tariffs and immigration restrictions trigger inflation or curb growth? Anticipated curbs to immigration could lower the boost to the hiring we have seen and ease upward pressure on the unemployment rate. A new Trump administration is expected to bring tax cuts, which should have a positive impact on growth. While the drag from tariffs and reduced immigration may be felt early in 2025, tax cuts will likely boost spending with a longer delay.

Can the U.S. grow in a world where Europe and China do not? The worlds’ economies have been operating at a slower pace than the U.S. in the post-pandemic echo-boom, but can the U.S. continue to thrive when everyone around them struggles? The threat of a trade war is at the top of mind, but the U.S. dominance in markets cannot continue in perpetuity.

Will AI infrastructure investment slow? Recent results from NVDA suggest that demand for its semiconductors continues to outstrip supply. Expect this to continue.

What will be the new theme? Obesity and AI are not surprising themes. But obesity, in particular, is starting to show signs of fading as a market driver. Over the past six months, shares of LLY have declined 14% and shares of NOVO are down over 35%. However, new themes arise every year, providing fertile ground for alpha.

New Year’s Resolution

Instead of a resolution to change something, let’s instead focus on what is likely to stay the same.

Artificial Intelligence. Looking ahead to the new year, AI promises to remain a theme (good or bad) in the market for 2025, but we are watching a series of other emerging themes to find which might capture the attention of investors in the year ahead.

Energy and Utilities. Growing power needs of data centers fuels demand for AI power. The Future of Utilities Capex remains strong as the need to power the Manufacturing Renaissance, as well as the continued electrification of the transportation complex, is clearing a path for sustained power growth.

Deglobalization. Increased tariff protection is likely to emanate from the U.S. How disrupted supply chains adapt to this evolving environment will be fascinating to see in the year ahead.

U.S. consumer. The end of the U.S. consumer is ALWAYS just around the corner, but it never seems to come around. Four years into the post-pandemic boom, it’s tempting to believe something could go wrong. Consumer strength should continue as interest rates continue to drop.

What has changed and what remains the same?

We have already discussed the AI stocks, but more broadly, we have had markets driven by a handful of stocks, mostly linked to the AI phenomenon. Some stocks, known as the Magnificent 7, over the past two years contributed 40% of the total index return. This return level is significantly above longer term expectations and exceeds the returns from past top performing cohorts from previous Technology, and Media and Telecommunications bubbles in the late 1990s and 2000s, respectively.

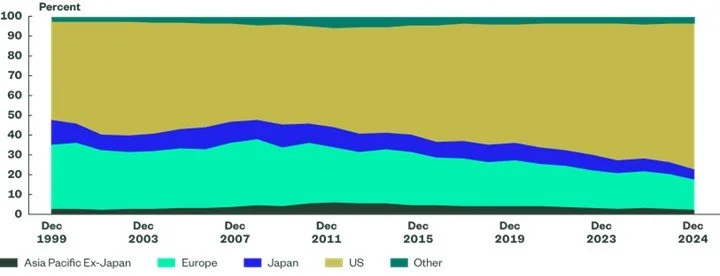

Since the U.S. stock market continues to outpace ex-U.S. markets, there has been a significant change to our index composition over the last few years. Our primary benchmark for equities, the MSCI ACWI (All Country World Index), was roughly 55% U.S. stocks, with the balance coming from International Developed and Emerging Markets stocks. Today, this is closer to 75%! Our investment committee has had a bias to U.S. Equities, with our benchmark at 70% U.S. Equities, which has resulted in significant outperformance. However, we now find ourselves UNDERWEIGHT to U.S. equities. Fear not: while our benchmark remains the same, we actively change our allocations to reflect the thoughts of the committee.

Source: MSCI, FactSet, State Street Global Advisors. Data as of 11/30/2024.

From the Investments Desk at MDL Wealth Management and Journey Strategic Wealth

This material is distributed for informational purposes only. Investment Advisory services offered through Journey Strategic Wealth, an investment adviser registered with the U.S. Securities and Exchange Commission ("SEC"). The views expressed are for informational purposes only and do not take into account any individual’s personal, financial, or tax considerations. Opinions expressed are subject to change without notice and are not intended as investment advice. Past performance is no guarantee of future results. Please see Journey Strategic Wealth’s Form ADV Part 2A and Form CRS for additional information.