Monthly Market Recap – April 2023

Markets Continue to Spring Higher

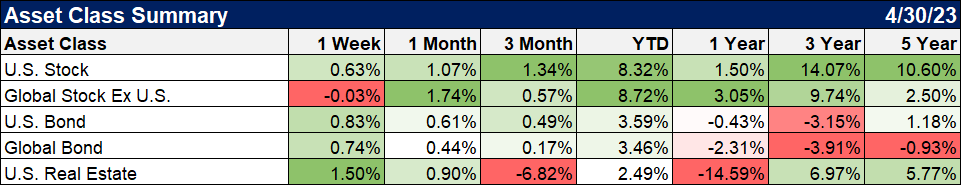

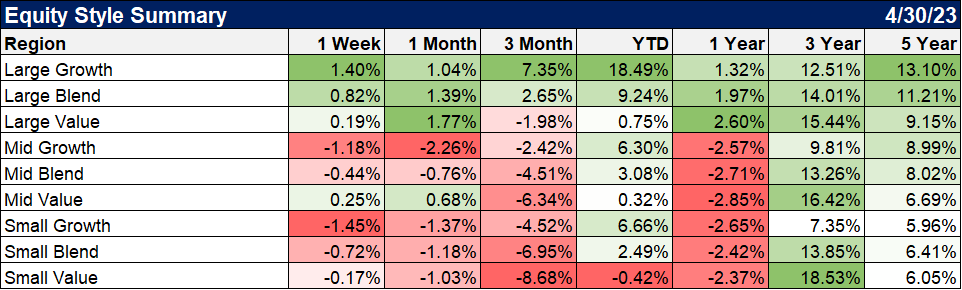

April was another positive month for stocks, with the exception of the small-cap Russell 2000 index. The Dow Jones Industrial Average rose 2.6%, the S&P 500 added 1.6%, and the NASDAQ eked out a 0.1% gain. The global equity picture was mixed—Developed Markets notched 2.9% higher, while Emerging Markets fell 1.1%. The Russell 2000 slipped 1.8%, marking its third consecutive monthly decline.

*10

*1

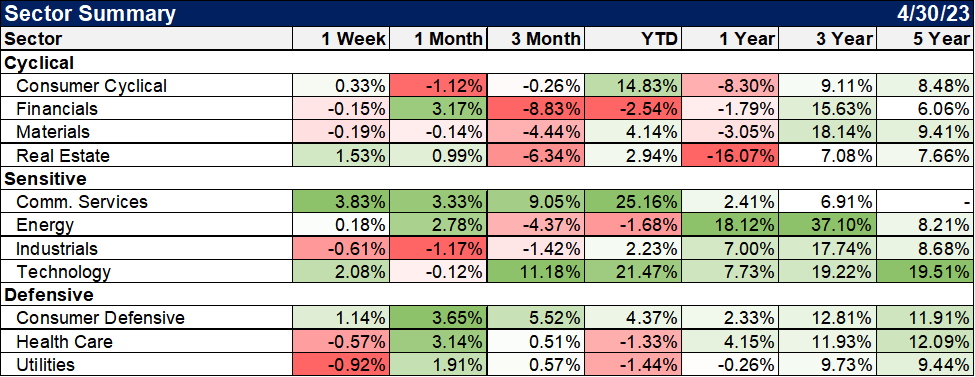

Seven of the 11 US stock sectors were positive in April, and four rose 3% or higher (Consumer Staples, Communication Services, Financials, and Health Care). April was a down month for cyclically-sensitive sectors, as Technology, Materials, Consumer Discretionary, and Industrials all took a breather.

*2

What has contributed to the market gains?

Earnings estimates for 2023 impressively rose last week.

With just over half of S&P 500 companies having reported results, the consensus estimate for S&P 500 year-over-year earnings growth in the first quarter is -3.7%, up more than 2 percentage points from the prior week. Among the companies reporting so far, 72% have beaten revenue estimates and 80% have beaten earnings estimates.

While an earnings recession is likely, with a second straight drop in quarterly earnings still nearly certain, a solid upside surprise relative to expectations is a pleasant development past the halfway point of the season.

The consensus estimates for S&P 500 earnings per share over the next 12 months and for calendar year 2023 both rose slightly last week amid strong results from mega-cap tech. Further estimate cuts during earnings season are likely to be modest.

Maybe the Federal Reserve is beginning to win the war against inflation?

US Inflation cooled further in March to 4.98%, though US Core Inflation hovered at 5.59%. The last time year-over-year Core Inflation exceeded year-over-year Inflation was January 2021. The US Consumer Price Index was flat month over month, as was US Personal Spending.

April’s US ISM Manufacturing PMI came in at 47.1, a rebound of 0.8 points but still putting the index firmly in contraction territory. US Retail and Food Services Sales declined 1% month-over-month, two months removed from its highest monthly increase since March 2021. The year-over-year US Producer Price Index rapidly cooled to 2.75% in March.

Initial and continuing claims for the latest week came in just below economists’ expectations as well as compared to the prior week. The labor market is expected to further loosen up during the second quarter as companies respond to slowing demand triggered by the Fed’s hawkish sentiment. Job openings hit their lowest level since April 2021 in a sign that the Federal Reserve's efforts to cool the job market through interest rate hikes is paying off. The latest Job Openings and Labor Turnover Survey (or JOLTS report) released Tuesday revealed 9.6 million job openings at the end of March, down from 9.9 million in February. In April 2021, they stood at 9.3 million.

The decline in job openings moves closer to the "better balance" in labor markets that Federal Reserve Chair Jerome Powell and other Fed officials have referenced.

So, we have the “all clear” signal then? Not necessarily.

The fallout from the Fed

Top of mind is yet another bank failure to close out of the month. This is expected to be the last “domino” to fall; however, there may be some additional ancillary impact yet to come.

Announced layoffs continue to climb and are increasingly reaching beyond just the Technology Sector, causing U.S. consumer confidence to decline to a nine-month low in April as worries about the future economic landscape mounted, with some believing the economy is headed for a recession later this year. Surveyed individuals planning to buy household appliances over the next six months dropped to 41%, which represents the smallest percentage since September 2011. In addition, the percentage of respondents planning to buy motor vehicles was the smallest in nine months.

Gross domestic product (GDP) increased in the first quarter of 2023 to 1.6% year-over-year, matching economists’ expectations. Seasonally adjusted GDP only grew 1.1% year-over-year, which came in short of estimates. The increase in real GDP was supported by consumer spending, exports, federal government spending, state and local government spending, along with non-residential fixed investment. Even with this increase, the Federal Reserve is still projecting a negative full-year GDP.

US Treasury yields broke 5% once again. The 3-Month and 6-Month Treasury Bills were the two durations to surpass 5% in April, at 5.18% and 5.06% respectively. April marked the 3-Month’s highest level since February 2007. The 5-Year’s yield of 3.51% was the lowest on the curve. Lastly, the 10-Year-3 Month Treasury Yield spread sunk to -1.65%, marking the spread’s largest inversion in history.

If you use inverted yield spreads to forecast recessions, then April was a month worth paying attention to. The 10-Year-3 Month Treasury Yield spread was inverted by as much as 173 basis points in April, marking its largest inversion ever. In March, the 10-2 Year Spread was flipped upside down by over 100 basis points and remained firmly inverted throughout April. Every recession since 1970 has been preceded by at least one of these yield spreads inverting. Is a US recession lurking around the corner?

*3, 4, 5, 6, 7, 8, 9

Key Takeaways:

Today’s uncertainties and challenges are not unlike those of years gone by, though the names may have changed. A few years from now, there will be many economists and analysts playing Monday morning quarterback, looking back on this period of time to determine what worked and what should have been done differently. Hindsight is 20/20.

Wouldn’t it be nice to be able to know now, what we will know in a few years from now.

1) Know why you are investing.

2) Have a plan – hope is not a strategy.

3) Follow your plan.

4) Don’t disrupt your long-term plan because of how you feel today or how you felt yesterday.

5) Don’t forget that diversification and time in the market play a key role in the success of your plan.

Remember yesterday, live for today, plan for tomorrow.

For more great insights, highlights, and financial education, follow

MDL Wealth Management on:

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk.

The economic forecasts set forth in this material may not develop as predicted, and there can be no guarantee that strategies promoted will be successful.

3Department of the Treasury

4Bank of America Merrill Lynch

5Federal Reserve

6University of Michigan

7Bureau of Labor Statistics

8Institute for Supply Management

9Census Bureau