Monthly Market Recap – August 2023

“Navigating by the stars under cloudy skies.” — Federal Reserve Chairman Jerome Powell

Aren’t we all, Jay, aren’t we all?

Stocks took a breather in August as the S&P 500 fell 1.6%, the Dow Jones Industrial Average slipped 2.0%, and the NASDAQ ended 2.1% lower. It was a disappointing month globally—EAFE sank 3.8% in August and Emerging Markets tumbled 6.1%. Nonetheless, August didn’t subtract too much from the upbeat year-to-date performance of major US indices. The NASDAQ is still up 34.1% in 2023, the S&P 500 is 17.4% higher, and the Dow 4.8%.

*10

*1

Energy was the only US stock sector that posted a positive return in August, up 1.6%. Utilities was the laggard of the remaining ten sectors, down 6.1%.

*2

The Economic Data Rundown:

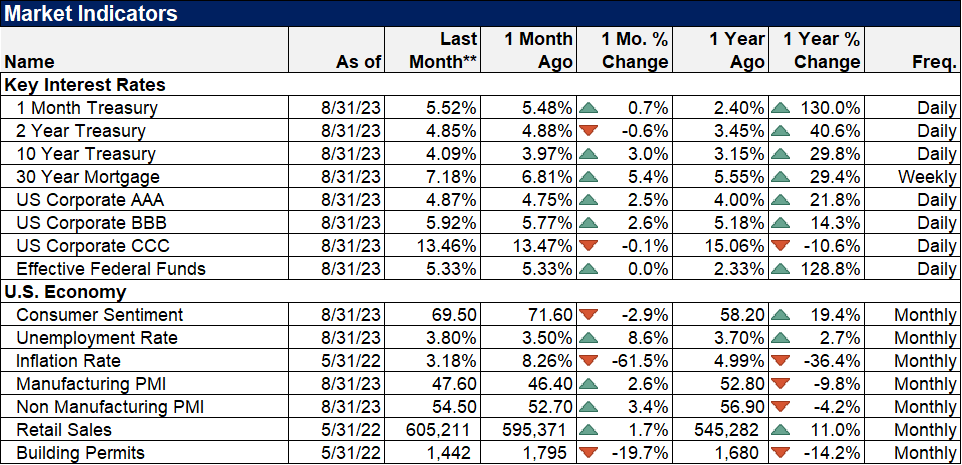

US Treasury Yields: US Treasury yields were largely flat in August, echoing the rather muted performance from equities. The 3-Month Treasury Bill, the highest-yielding US treasury instrument, stood at 5.56% at month’s end, and the 10-Year was the lowest at 4.09%. In global fixed income, the yield on Japan’s 10-Year Government Bond rose by 5 basis points to 0.66%.

Employment: August’s unemployment rate rose to 3.8%, three-tenths higher than July’s figure of 3.5%. However, the labor force participation rate grew by two-tenths to 62.8%. In August, 187,000 jobs were added, surpassing nonfarm payrolls expectations of 170,000.

Consumers and Inflation: After dipping below 3% for the first time in over two years, inflation inched higher in July to 3.18%, up from 2.97% in June. Core Inflation did fall in July to 4.65%. The US Consumer Price Index rose a slight 0.17% in July, while month-over-month (MoM) US Personal Spending rose at a higher MoM clip for the second straight month to 0.79%.

Production and Sales: The US ISM Manufacturing PMI rebounded in August by 1.2 points to 47.6. However, as it’s still below 50, the key manufacturing index remains in contraction territory. US Retail and Food Services Sales grew by 0.73% MoM in July, and the year-over-year (YoY) US Producer Price Index rose 0.80%.

Housing: MoM US New Single-Family Home Sales increased 4.4% in July, following a June in which new home sales contracted. However, US Existing Home Sales sank for the 16th month out of the last 18, down 2.2% in July. The mixed housing data resulted in the Median Sales Price of Existing Homes leveling off, slipping 0.8% to $406,700. Mortgage rate increases were largely negligible in July: 15-Year and 30-Year Mortgage Rates closed out the month at 6.55% and 7.18%, respectively. The 30-year mortgage rate has not been this high since early 2001.

Commodities: The price of Gold fell 2.8% in August from $1,970.70 to $1,915.50. Oil prices were mixed in August—the price of WTI per barrel slipped 1.4% to $80.65 while Brent inched 0.2% higher to $85.42. The average price of regular gas rose 1.6% in August despite the mixed data, up 6 cents per gallon to $3.93 as of month’s end.

*3, 4, 5, 6, 7, 8, 9

Key Takeaways:

In describing setting monetary policy, Federal Reserve Chairman said it is like “navigating by the stars under cloudy skies.” The markets are getting comfortable with a Fed fully aware of a toolbox full of limitations.

The Fed is currently very close to the place where the risks of doing too much are roughly in line with the risks of doing too little. One main reason for risk management is the lagged effects of monetary policy. Tightening credit conditions take time to filter through the economy, so that’s why policymakers are concerned about the unknown effects yet to emerge on the economy. The Fed is focusing on risk management now and carefully dissecting the data for any emerging economic cracks.

The Fed is highly data dependent and will be ready to hold rates unchanged if the data clearly supports the notion that inflation is trending close to the 2% target. While the general trend of economic data points to a slowing economy, there are still pockets of relative strength, like stronger-than-expected services sector data for August that fueled concerns of sticky inflation and interest rates staying higher for longer. With the mixed economic data, expectations are that the Federal Reserve will leave rates unchanged at their September meeting but raise them in November.

The Federal Reserve and business leaders will also be watching as the student loan moratorium comes to an end. For those who must start paying their loans again at the beginning of October, it may feel like an immediate 5% pay cut, putting a further strain on their spending—and therefore, the economy—as we inch closer to the all-important holiday shopping season.

For more great insights, highlights, and financial education,

follow MDL Wealth Management on:

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk.

The economic forecasts set forth in this material may not develop as predicted, and there can be no guarantee that strategies promoted will be successful.

3Department of the Treasury

4Bank of America Merrill Lynch

5Federal Reserve

6University of Michigan

7Bureau of Labor Statistics

8Institute for Supply Management

9Census Bureau