Monthly Market Recap – July 2023

Did you know? The S&P 500 has gained 20% this year, which was its best performance through the first seven months of the year since 1997. The Nasdaq Composite outperformed that, surging 37%, which was the index's best performance through the first seven months of the year since 1975, a far cry from the expectations at the start of the year.

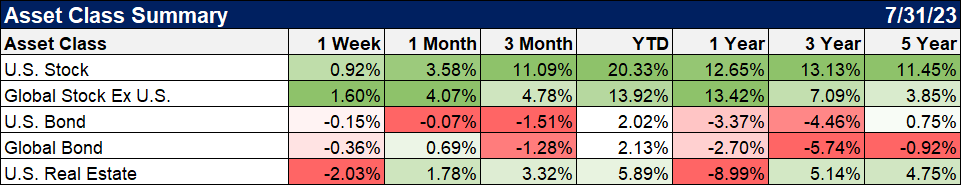

Stocks continued their steady climb higher in July as the NASDAQ rose 4.1%, the Dow Jones Industrial Average advanced 3.4%, and the S&P 500 tacked on another 3.2%. Emerging Markets was the top performer in July at 6.3%, and the Russell 2000 Small Caps index was right behind at 6.1%.

*10

*1

All 11 US stock sectors posted positive returns for the second consecutive month. A double-digit percentage increase in oil prices in July sent the Energy sector 7.8% higher, followed by Communication Services at 5.7% and Financials at 4.8%.

*2

The Economic Data Rundown:

US Treasury Yields

In stark contrast to last month, short- and long-term US Treasury yields shot higher in July, while the middle of the yield curve spectrum was largely unchanged. The 1-Month and 3-Month Treasury Bills increased by 24 and 12 basis points, respectively. The 10-Year and 20-Year both rose by 16 basis points, while the 30-Year notched 17 basis points higher. The 2-Year, 3-Year, and 5-Year notes rose by no more than 5 basis points each, while the 1-Year fell by 3 bps.

Employment

June’s unemployment rate came in at 3.6%, one-tenth of a percentage point lower Month-over-Month (MoM). The labor force participation rate remained unchanged at 62.6% for the fourth straight month. In June, 209,000 jobs were added to the economy, falling a bit short of expectations. Economists had forecasted 240,000 non-farm payrolls for the month.

Consumers and Inflation

US Inflation fell below 3% for the first time since March 2021, clocking in at 2.97%. Core Inflation fell below 5% for the first time since November 2021, coming in at 4.83% for June. The US Consumer Price Index rose a slight 0.18% in June, though MoM US Personal Spending grew at a higher rate of 0.55%. Additionally, the Federal Reserve resumed hiking the Target Federal Funds Rate at its July 26th meeting, raising the benchmark interest rate by 25 basis points to 5.50%. This marked the 11th rate hike in the last twelve Fed meetings.

Production and Sales

The US ISM Manufacturing PMI leveled off slightly in July, rising 0.4 points to 46.4. However, the key manufacturing index remains firmly in contraction territory. US Retail and Food Services Sales rose 0.19% MoM, and the Year-over-Year(YoY) US Producer Price Index rose only 0.13% in June, its smallest monthly change since August 2020.

Housing

US New Single-Family Home Sales contracted 2.5% in June, while US Existing Home Sales sank 3.3%. Despite the down month for home sales, the Median Sales Price of Existing Homes climbed 3.5% to $410,200. Mortgage rate increases were largely negligible in July—15-Year and 30-Year mortgage rates closed out the month at 6.11% and 6.81%, respectively.

Commodities

The price of gold increased by $40 an ounce in July, up from $1,912.30 to $1,954.30. Oil prices climbed all throughout July; the price of WTI per barrel surged 11.5% to $78.81 and Brent rose 10.8% to $82.53. Higher oil prices caused the average price of regular gas to rise 18 cents per gallon in July to $3.87 at month’s end.

*3, 4, 5, 6, 7, 8, 9

What about the recession?

Many CEOs, investors and economists had penciled in 2023 as the year when a recession would hit the American economy.

The thinking was that the US economy would stall due to the Federal Reserve’s rampant pace of rate hikes to reel in inflation. Businesses would lay off workers, and consumers would slash spending.

Although it is true that the economy is slowing and companies are laying off workers, the main reason that a recession no longer seems to be in the cards—at least for 2023—is that America’s jobs market is still way too strong. We’ve never had a recession when the labor market was running this hot.

Many economists and analysts have been changing their tune as of late and are now suggesting pending recession will officially begin in the 1st quarter of 2024, but they have also begun to adopt the idea that it could be a rather mild recession. Some are even beginning the chatter about a soft landing or no recession at all.

We will have to wait and see.

For more great insights, highlights, and financial education,

follow MDL Wealth Management on:

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk.

The economic forecasts set forth in this material may not develop as predicted, and there can be no guarantee that strategies promoted will be successful.

3Department of the Treasury

4Bank of America Merrill Lynch

5Federal Reserve

6University of Michigan

7Bureau of Labor Statistics

8Institute for Supply Management

9Census Bureau